Customer-Oriented Business Management Policy

We prioritize customer satisfaction, as specified in our action guidelines (MST Way). Based on this principle, we have formulated and published a 'Customer-oriented Management Policy' to ensure thorough implementation of customer-focused initiatives. We execute these initiatives in accordance with this policy.

June 27th, 2024

- We uphold the highest value on customer satisfaction as our core commitment, as part of our guiding principles (MST Way).

- Based on the action guidelines, all of our officers and employees are committed to sincerely listening to our customers' voices and striving to provide products and services that truly benefit them.

- We commit to regularly reviewing and evaluating our efforts regarding the customer-oriented business operation policy and continuously work to develop a system to constantly improve our performance.

Initiatives (1)

1) Establishing and Promoting Internal Understanding of the Customer-oriented Management Policy

- We have established a Customer-oriented Management Policy and are working to promote its understanding within the company, including regularly delivering messages from top management.

2) Enhancing Operational Quality by Incorporating Customer Feedback

- We collect customer dissatisfaction, requests, and compliments gathered through daily activities and ensure that important matters are addressed by management and relevant departments. We maximize the use of customer feedback to enhance operational quality through this initiative.

- We centralize customer complaints in the Comprehensive Risk Management Department and periodically report them to management to ensure appropriate actions are taken. For significant complaints, we report them to the Board of Directors and take organized measures to prevent recurrence.

3) Establishing and Strengthening the Framework for Promoting Customer-oriented Business Operations

- We operate the Customer Satisfaction (CS) Committee to periodically review activities related to customer-oriented management, identify issues to be addressed for further advancements, and formulate countermeasures. In 2023, the committee held two meetings, in May and November.

- We operate a system to check and verify the status of activities and analyze customers’ feedback to improve the quality of our operations through the cooperation of related departments in the company. In 2023, discussions were held 22 times to confirm and verify the situation and to formulate improvement plans.

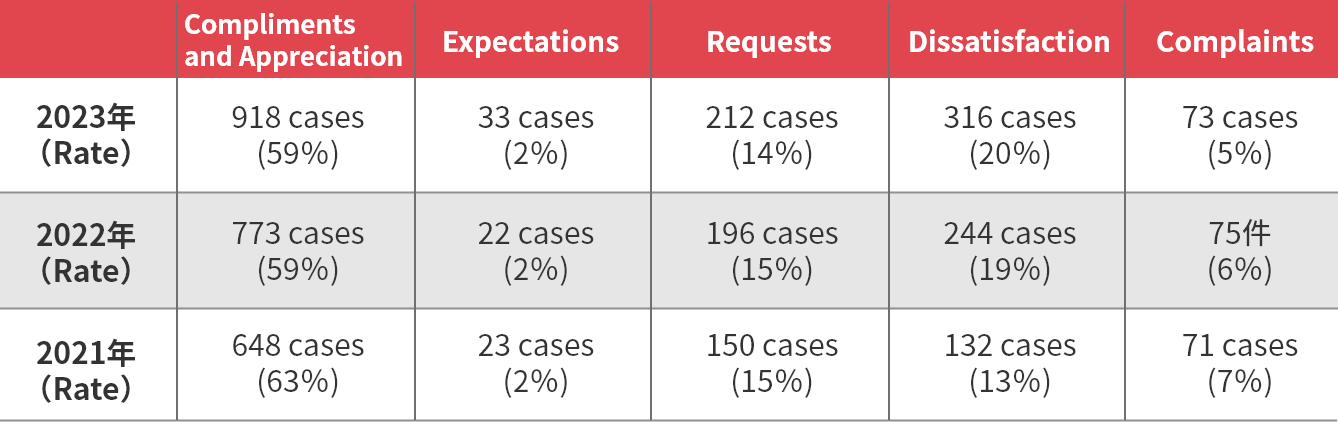

[Status of Customer Voices Reception]

We recognize and analyze customer compliments, requests, and dissatisfaction as part of our initiative to prioritize customer satisfaction as the highest value. We use 'customer voices' as an indicator in our business operations to measure the status of our activities.

[Initiatives to improve our operational quality]

- Publication of the 'Customer Voice newsletter

We share information through internal newsletters that introduce initiatives and key points based on feedback from customers, with the aim of providing better services to our customers. - Identifying and addressing issues from the perspective of insurance companies

We conduct interviews to identify issues in our customer-oriented management from the perspective of insurance companies and promote initiatives to address and solve these issues. - We implemented initiatives to emphasize the importance of utilizing customer feedback to improve operational quality. These included reinforcing this message in sales meetings and delivering messages to higher managerial levels, urging them to demonstrate leadership.

- We are committed to firmly establishing a corporate culture that values customer satisfaction as the highest priority by fostering awareness among executives and employees and ensuring thorough internal education.

Initiatives (2)

1) Establishment and implementation of a code of conduct

- We have established a code of conduct as a standard to guide how executives and employees think, make decisions, and act daily, in order to instill professional ethics as a financial service provider. We conduct annual training sessions to review departmental initiatives and raise awareness.

[Thorough implementation of the code of conduct]

- We conducted trainings aimed at encouraging each individual to recognize the code of conduct as a personal matter, with department heads serving as instructors for each department. Additionally, before the departmental training sessions, we held separate trainings specifically for department heads.

2) Compliance enforcement

- We not only explain rules but also conduct training programs in compliance education to ensure that employees truly understand them.

[Compliance enforcement]

- We conducted 16 compliance training sessions in an e-learning format in 2023.

- One-point monthly advice: We provided employees with detailed explanations on key points to consider and the background of compliance and insurance solicitation.

3) Acquisition of specialized knowledge as an insurance agency

- We conduct education and training programs for executives and employees on specialized financial knowledge and product expertise to accurately understand customer needs and provide appropriate advice and proposals. Through these efforts, we are working toward becoming a trusted risk management service company for our customers.

* For more information on our specific efforts to acquire expertise, please visit here.

- We recommend products that align with our customers' preferences during insurance solicitation and sales, without being influenced by the amount of commission or any other factors.

- We strive to ensure that our customers' interests are not unduly harmed by accurately identifying potential conflicts of interest in transactions and managing and responding to them appropriately.

Initiatives (3)

1) Establishment and management of an appropriate insurance solicitation system

- We work on establishing and managing an insurance solicitation system that prevents transactions which could unduly harm our customers' interests by appropriately understanding their preferences, providing comparative recommendations, and explaining key details.

- We verify the status of conflict of interest management through monitoring.

[Establishment and management of an appropriate insurance solicitation management system]

- We have established detailed implementation rules for the entire solicitation process, including understanding customer preferences, providing comparative recommendations, and explaining key details. Additionally, we have developed a system for new contracts to record the implementation status in the sales system.

- Monitoring: The management department samples new contracts every month and verifies the appropriateness of the entire solicitation process in detail.

- We have introduced macro monitoring to check whether comparative recommendations are made in an unbiased manner to improve our systems.

2) Employee education on conflicts of interest

- We provide compliance training to educate officers and employees, ensuring the prevention of transactions that unfairly harm customer interests.

[Employee education]

- We continue to provide solicitation compliance training annually, regular confirmation tests six times a year, and monthly performance checks for all employees.

- We have clearly defined selection rules that prioritize customers' interests for each customer attribute. Our training programs and regular confirmation tests emphasize the proper understanding of these rules for selecting recommended products.

- We propose products and services that are suitable for customers after fully understanding their wishes and needs.

- We provide clear and detailed explanations of important information to customers, ensuring they can select suitable products and services. We also strive to deliver appropriate and sufficient information tailored to the characteristics of the products and services being offered.

- We offer customers information and propose products and services tailored to their knowledge and understanding of insurance products and finance, past experience, knowledge and interests, financial situation, and purpose of purchasing insurance.

Initiatives (4)

1) Accurate understanding of customers’ wishes and appropriate suggestions

- We assess customers' risks and wishes to propose suitable insurance products and plans. For products with market risks, such as foreign currency-denominated and variable insurance, we ensure sufficient explanations of the products and risks, taking into account customers' needs, knowledge, investment experience, contract objectives, and financial status.

[Efforts to accurately understand customers’ wishes and make appropriate suggestions]

- We ensure accurate understanding of customers' wishes through a double-checking system where recorded preferences are reviewed by both the sales representative and other staff in the sales department. Additionally, the management department monitors the reviewed items.

- We ensure the appropriateness of fire insurance for corporate customers by using our proprietary check sheet within the sales organization to confirm that the insurance application aligns with the customer’s wishes and property conditions.

2) Providing necessary information and providing thorough explanations to customers

- We provide customers with the information necessary to determine the suitability of signing up when proposing products and services.

- We use product outline materials and brochures to explain important information, such as the reasons for selecting products and services, in a clear and accessible way.

- We simplify technical terms into plain language and highlight key information to ensure that customers can properly understand the contract outline and cautionary details.

- We take steps to prevent misunderstandings and promote understanding when confirming with elderly customers. These include providing explanations multiple times, involving more than one person in charge, and sending a thank-you letter after the contract is signed.

[Providing necessary information and thorough explanations to customers]

- We have established a series of solicitation processes and rules for dealing with elderly customers in internal procedures. We are working to ensure the appropriateness of these procedures by checking the records of the processes within the sales organizations and verifying them through monitoring by the management department.

3) Confirmation of customer’s wishes prior to conclusion of contract

- Even just before customers sign a contract, we confirm whether the product they are signing meets their wishes and whether they understand the terms of the contract.

[Providing customers with necessary information and clear, thorough explanations]

- We have established internal procedures for solicitation processes and rules for dealing with elderly customers. To ensure their appropriateness, we check process records within the sales organizations and verify them through monitoring by the management department.

4) Internal training to provide customers with proper information and suitable product proposals.

- We strive to enhance our internal education system by developing training curriculums aimed at ensuring that sales agents acquire the skills needed to provide clear, sufficient information based on customers' wishes and needs, as well as to propose appropriate products and services.

[Internal education initiatives]

- We strive to improve practical skills through role-playing training that simulates a series of solicitation processes, enhancing information provision and product proposal capabilities.

5) After-sales support

- We continue to support our customers even after they sign a contract by providing useful information, such as an overview of their purchased product and market trends. We also offer advice and suggestions on potential risks they may face, ensuring that we assist them from a long-term perspective.

- We have a dedicated department (Security Service Department) to provide expert advice in case of accidents, ensuring that our customers receive appropriate support regarding non-life insurance.

- We ensure that customers receive complete information about the expiration of their contracts to prevent them from unintentionally becoming uninsured.

[After-sales initiatives]

- We recognize accident response and insurance expiration notifications as essential operations and define them in our internal regulations, just as we do with the solicitation process. To ensure a systematic verification system, we have established organizational measures and provide internal training and education.

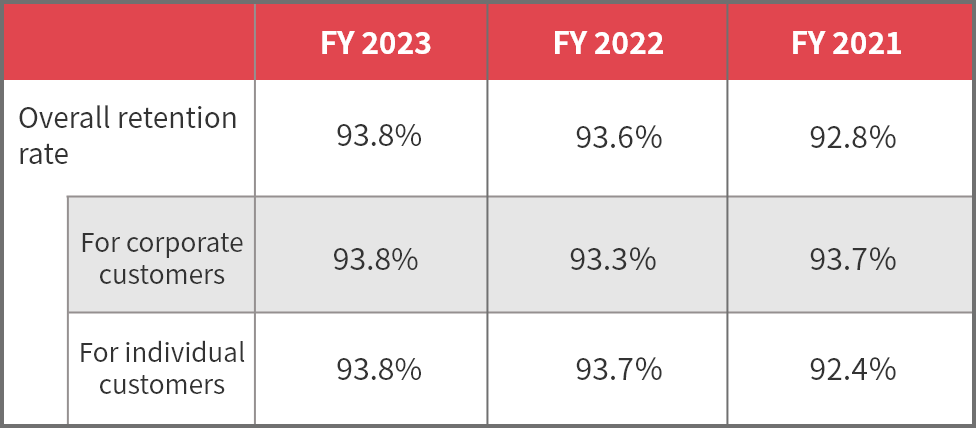

Retention rate of non-life insurance contracts(*)

*This figure represents the percentage of contracts that matured between April 2023 and March 2024 and were renewed.

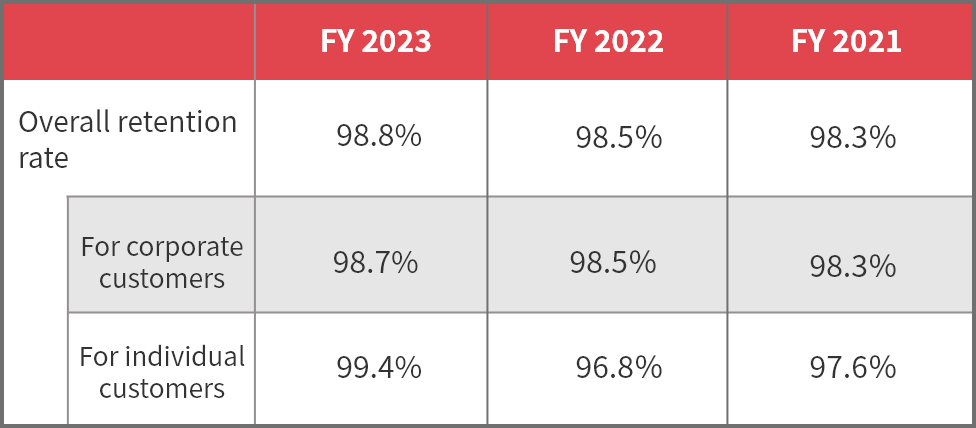

Retention rate of life insurance contracts(*)

*This figure represents the percentage of the total annualized premiums for contracts signed between April 2022 and March 2024 that remain effective as of April 1, 2024.

We believe that retention rates reflect the success of our commitment to placing the highest value on customer satisfaction. Therefore, we use the non-life insurance policy retention rate and life insurance policy retention rate as indicators to measure the effectiveness of our initiatives.

- We ensure initiatives for business operations that prioritize the highest value on customer satisfaction by evaluating the performance of organizations and individuals, reflecting the results, and continuously reviewing and improving our initiatives.

- We strive to provide comprehensive education and training to ensure our employees acquire the knowledge and skills necessary for customer-oriented consulting.

Initiatives (5)

1) Performance evaluation of organizations and individuals

- We consider not only sales performance but also operational quality, customer feedback, compliance, and other factors when evaluating the performance of internal organizations and individuals. This approach ensures a balanced assessment that fosters long-term business relationships with our customers.

2) Education for acquiring specialized knowledge

- We establish an education system to equip our officers and employees with specialized financial and insurance knowledge. This enables them to effectively respond to rapidly increasing social risks and a wide range of customer needs in a timely and appropriate manner.

3) Establishment of internal procedures and monitoring of proper business operations

- We regularly reinforce awareness of internal procedures and important matters to ensure thorough dissemination.

- We work to develop internal procedures and establish a monitoring system that supports continuous quality improvement. This ensures that we accurately understand customers' needs, make appropriate proposals aligned with their expectations, and provide sufficient and thoughtful information to them.

[Appropriate business operation and monitoring]

- We have established an evaluation system that emphasizes operational quality and compliance by setting items for internal control.

- We have established internal procedures that define essential requirements in the solicitation process, including understanding customers’ intentions, making proposals, explaining key matters, and confirming their intentions. In particular, for new contract solicitations, we require employees to keep detailed records of the solicitation process. These records are reviewed within the sales organization and verified through monitoring by the management department to ensure appropriateness.

- We assign managers responsible for insurance solicitation to all sales organizations and work closely with the management department to conduct monitoring and provide practical employee training at sales sites.

[Progress on our initiatives to acquire specialized knowledge]

Number of qualified employees(*1)

FY 2023

FY 2022

FY 2021

Non-life Insurance College Course

793 people

783 people

758 people

Life Insurance College Course

653 people

678 people

621 people

Insurance broker

206 people

193 people

188 people

Qualifications equivalent to 2nd grade FP (Financial Planner)(*2) or above

393 people

356 people

338 people

(*1) The ratio of those who hold any of the above qualifications to the number of sales agents is 87%.

(*2) Referring to 2nd grade Certified Skilled Professional in Financial Planning, AFP (Affiliated Financial Planner), and 2nd grade Financial Skilled Worker.

Among the holders of qualifications equivalent to 2nd grade FP or above, 28 people have obtained 1st grade Certified Skilled Professional in Financial Planning or CFP®.

-

Our training

We conduct training to acquire systematic knowledge and skills, as well as on-demand training that can be attended at any time or place. We will further enhance the training programs. We also provide online training to be attended at any place that has become popular since the COVID-19 pandemic.

-

Annual curriculum

We organize the curriculum by level and theme throughout the year. A total of 119 training sessions were held in FY 2023.

-

On-demand Training

We conduct on-demand training that employees can take at their own pace. As of the end of FY 2023, we provided 49 sets of training materials.

Number of qualified employees(*1)

| FY 2023 | FY 2022 | FY 2021 | |

|---|---|---|---|

| Non-life Insurance College Course | 793 people | 783 people | 758 people |

| Life Insurance College Course | 653 people | 678 people | 621 people |

| Insurance broker | 206 people | 193 people | 188 people |

| Qualifications equivalent to 2nd grade FP (Financial Planner)(*2) or above | 393 people | 356 people | 338 people |

(*1) The ratio of those who hold any of the above qualifications to the number of sales agents is 87%.

(*2) Referring to 2nd grade Certified Skilled Professional in Financial Planning, AFP (Affiliated Financial Planner), and 2nd grade Financial Skilled Worker.

Among the holders of qualifications equivalent to 2nd grade FP or above, 28 people have obtained 1st grade Certified Skilled Professional in Financial Planning or CFP®.

We conduct training to acquire systematic knowledge and skills, as well as on-demand training that can be attended at any time or place. We will further enhance the training programs. We also provide online training to be attended at any place that has become popular since the COVID-19 pandemic.

We organize the curriculum by level and theme throughout the year. A total of 119 training sessions were held in FY 2023.

We conduct on-demand training that employees can take at their own pace. As of the end of FY 2023, we provided 49 sets of training materials.

Reference: Relationship between our Customer-Oriented Business Management Policy and the Financial Services Agency’s Principles for Customer-oriented Management We have adopted the Financial Services Agency’s Principles for Customer-oriented Management and established the Customer-Oriented Business Management Policy to ensure thorough implementation of our initiatives. The relationship between our company’s management policy and the Financial Services Agency’s principles is as follows.

| Our management policy | Financial Services Agency’s principles |

|---|---|

| Management Policy 1 | Principle 2, Principle 2 (Note) |

| Management Policy 2 | Principle 2, Principle 2 (Note) |

| Management Policy 3 | Principle 3, Principle 3 (Note), Principle 4 |

| Management Policy 4 | Principle 4, Principle 5, Principle 5 (Note 1), (Note 3) to (Note 5)*1, Principle 6, Principle 6 (Note 1), (Note 4) to (Note 5)*2 |

| Management Policy 5 | Principle 7, Principle 7 (Note) |

- * For the Financial Services Agency’s Principles, please refer to the Agency’s website.

- * The Financial Services Agency’s Principle 1 relates to the formulation and publication of customer-oriented management, and there is no corresponding management policy.

- *1 The products we handle do not include “products that package multiple financial products or services” stipulated in Principle 5 (Note 2) and Principle 6 (Note 2).

- *2 We are not a “financial business operator engaged in structuring financial products” stipulated in Principle 6 (Note 3).

Please refer to the

'Table showing the correspondence relationship [as of June 2024]' ( / 681KB)

/ 681KB)

for the relationship with the Financial Services Agency’s Principles for Customer-oriented Management.